If you’ve ever downloaded a budget app, opened it once, then ghosted it for six months, same. I wanted something that would actually work for a real family schedule, not a finance influencer with twelve color‑coded accounts and unlimited patience.

So I did what any slightly obsessive person would do. I downloaded six of the big budget apps people keep recommending, used each one for at least a week, then asked a simple question:

Does this make managing money easier or harder for a tired parent with a normal brain?

Here’s how that went, what I’d use each app for, and the one I’m sticking with.

The problem with most budget apps

On paper, most of them look amazing. Charts. Categories. Goals. Alerts. But when you’re living paycheck to paycheck or juggling uneven income, what you actually need is:

Something fast

Something forgiving when you forget for a few days

Something that helps you see “what can I spend today” without doing math in your head

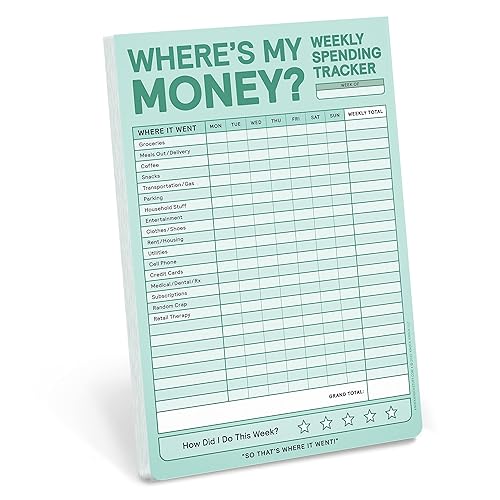

A lot of guides on “best budget apps” talk in general terms about features. I wanted to know which ones actually helped me do the stuff you talk about in your real‑life posts: finding budget leaks, building a bills calendar system, making a brutally honest budget that finally worked.

App 1: The “connect all your accounts” overachiever

Several of the big apps start with “connect every bank, every card, every loan.” On the plus side, you get a complete picture. On the downside, it’s overwhelming and a little creepy if you’re anxious about security.

Pros:

Automatic tracking

Nice graphs

Good for people who love seeing net worth charts

Cons:

Takes a while to set up

Can feel judgy when all your mistakes are in one place

Not great if you and your partner are both a little avoidant about money

If you’re in a “living paycheck to paycheck and trying not to cry” season, like in living paycheck to paycheck with a family, this type of app might be too much right now.

App 2: The strict envelope‑style app

This one is built around giving every dollar a job and sticking to categories like digital envelopes. Honestly, it lines up really well with the thinking behind your saved $400 a month with 5 simple changes and budget with uneven income simple system.

Pros:

Very good for people who like clear rules

Helps you think ahead instead of looking backward

Great if you can sit down once a week and “give jobs” to money

Cons:

Learning curve

Can feel intense if you’re already burned out

Not ideal if your income is extremely unpredictable and you’re constantly adjusting

I liked this one the most conceptually, but in my tired‑mom reality, it required more focus than I had some weeks.

App 3: The “round up your purchases” savings app

This one connects to your cards and rounds up every purchase, tossing the spare change into savings or investments. It’s cute, but if your budget is very tight, you might not want surprise extra money leaving your account.

Pros:

Good for people who never save at all

“Set it and forget it” once you trust it

Cons:

Doesn’t fix the underlying budget

Can overdraw accounts if you’re not careful

I’d use this after you’ve done a where does my money go check‑in and tightened your basics, not before.

App 4: The shared “household board” app

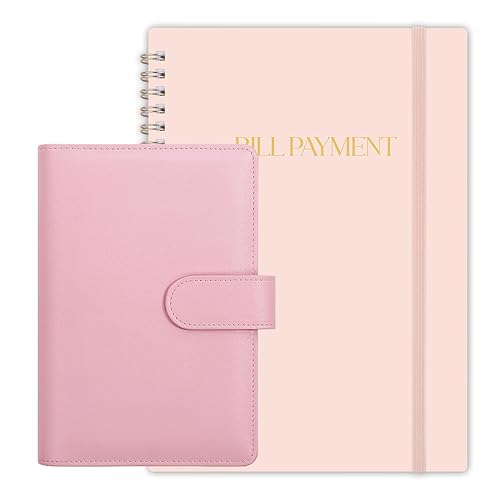

This one works more like a shared to‑do list with money sections. You can both see bills, goals, and notes. It reminded me a lot of your bills calendar system that stops late fees, but in app form.

Pros:

Good for couples who want to be on the same page

Works well with irregular income

Can store scripts for calls, like your subscription audit cancel script

Cons:

Not as automated

You have to actually type things in regularly

Better for planners than avoiders

App 5: The “transaction‑only” tracker

This style is basically a digital spending journal. No intense categories, no goals. Just a simple list of “this is what came in, this is what went out” and maybe some tags.

Pros:

Very low pressure

Helps you see patterns (“wow, that’s a lot of takeout”)

Pairs perfectly with a more emotional guide like the brutally honest budget that finally worked

Cons:

You have to be honest and log things

No automatic bill reminders unless you add them

I liked this for a reset month, especially if you’re also working through something like stop the Amazon spending spiral.

App 6: The simple “today view” app (the one I kept)

The app I kept long‑term did three things really well:

Showed my “safe to spend today” number

Let me make basic buckets (bills, groceries, gas, fun)

Let me reset and adjust without scolding me

It didn’t try to be my entire financial life. It just kept me from blowing the week’s grocery money accidentally on random Amazon orders, the exact thing you write about in Amazon spending out of control how to stop.

I’d log in, see:

Bills covered? Yes.

Groceries envelope? $X left.

Fun money? $Y left.

And that was enough to decide if the Target run needed a hard boundary or not.

Why I think “boring but clear” beats fancy features

A lot of apps try to impress you. Charts, AI insights, cashback offers. Most families don’t need more noise. They need:

One place that says, “Here’s what’s due, here’s what you already spent, here’s what’s left.”

That’s exactly what you’re building with your content: simple, honest systems like where does my money go and saved $400 month 5 simple changes. The app is just a tool to support that, not replace it.

My suggestion: pick one app that:

Lets you see upcoming bills

Shows what’s “safe to spend”

Feels easy to update even when you’re tired

Then layer it on top of your written systems: bills calendar, budget, subscription audit, Amazon rules. The app keeps the numbers visible. Your routines actually change them.

FAQs

Do I really need a budget app if I already use a notebook?

You don’t have to, but apps help with reminders and quick checking on the go. A lot of families do best with a hybrid: notebook or printable for big‑picture planning, app for daily “what can I spend today” decisions.

What should I track in the app if I feel overwhelmed?

Start with just three things: income, bills, and groceries. Once that feels normal, add categories for fun spending or debt payments. You don’t have to track every coffee from day one.

Which app is best if my income is uneven?

Look for one that lets you assign money to bills as it comes in instead of assuming a steady paycheck. Then use your budget with uneven income simple system as your actual rules and let the app reflect that.

How often should I check my budgeting app?

Aim for a quick daily glance (30 seconds) and one slightly longer weekly check‑in. Tie it to something you already do, like your Sunday reset or weekly routine that keeps me from burning out.

What if my partner won’t use the app at all?

You can still benefit from using it yourself. Share screenshots or quick “here’s what we have left for groceries and fun this week” summaries. If they hate apps, let them use a simple cash envelope or written list while you maintain the digital side.

Can a budget app help me find “extra” money for savings?

Yes, but only if you actually look at the patterns. Use one month’s data to answer “where does my money go,” then pair it with actions from posts like subscription audit and stop the Amazon spending spiral.

What if I’ve tried three apps already and none stuck?

Treat the app as optional and the habits as primary. Start with a pen‑and‑paper system from the brutally honest budget that finally worked and add an app later if it feels helpful. Tools should make life easier. If they don’t, they’re not the right fit.