If your income is uneven, most budgeting advice feels like it was written for someone else.

- The biggest mistake people make with uneven income

- The “Two Bucket” system (simple and solid)

- Step 1: Choose your “worst normal month” number

- Step 2: List your essentials (and stop lying to yourself)

- Step 3: Create bill guardrails (so you don’t miss stuff)

- Step 4: Use a weekly plan, not a monthly fantasy

- Step 5: Build a “low week” grocery default

- Step 6: Handle “good weeks” without blowing them

- Step 7: Protect yourself from the two biggest leaks

- Do this today (20 minutes)

- FAQ

- What if my income is extremely unpredictable?

- Should I use cash envelopes?

- How do I build a buffer if I’m barely surviving?

- Bottom line

Like the people who get paid the same amount every Friday and have never experienced the “big check, then nothing” stretch. Or the “this month is great, next month is weird” reality.

Uneven income doesn’t just mess with your bank account. It messes with your brain. Because you can’t relax after a good week. You’re already worried about the next slow week.

This post is the budgeting system that actually works for irregular income. It’s not fancy. It’s not a spreadsheet Olympics. It’s a simple system that stops money panic and gives you a plan you can repeat.

And if you’re reading this while thinking “my money disappears and I don’t even know why,” start here first: where does my money go? find budget leaks. Because uneven income + hidden leaks is a brutal combo.

The biggest mistake people make with uneven income

The mistake is budgeting like you’ll make your best month every month.

That’s when things fall apart. Because you build a life that only works when your income is high, and then a slower month shows up and everything feels like an emergency.

The goal is not to budget for your best month.

The goal is to build a budget that survives your worst normal month.

Not your absolute worst crisis month. Your worst normal month.

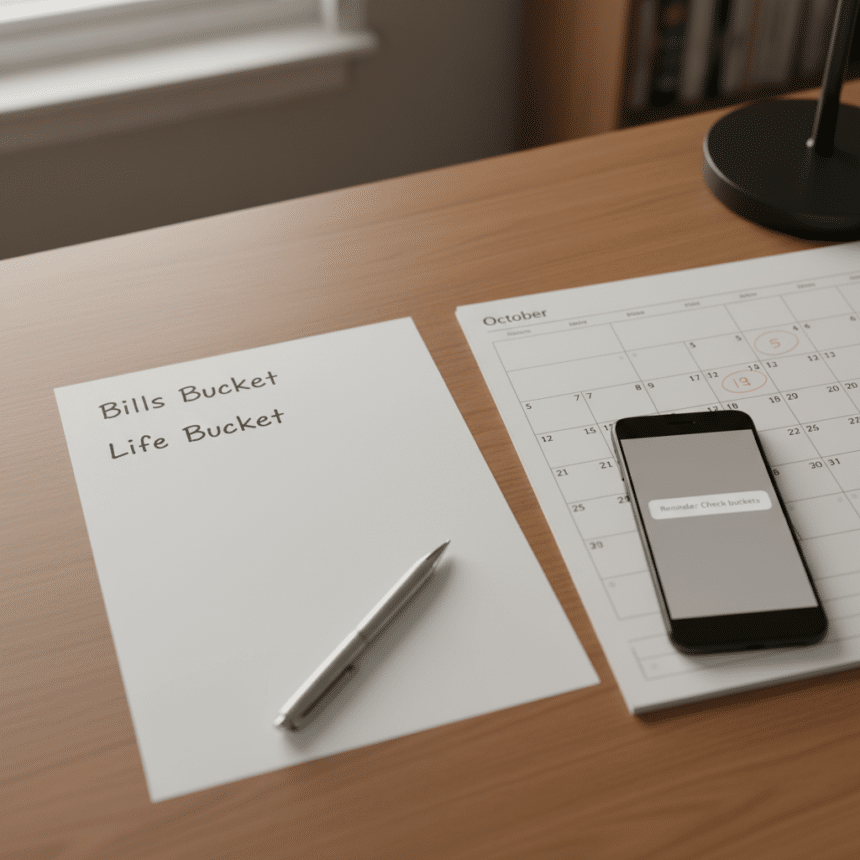

The “Two Bucket” system (simple and solid)

You’ll use two buckets:

- Bills Bucket: must-pay bills and essentials

- Life Bucket: groceries, gas, household needs, school stuff, everything else

When money comes in, you fund the buckets in order. Bills first. Life second. Extras last.

This removes the guessing and stops the “I got paid so I can breathe” trap that turns into overspending.

Step 1: Choose your “worst normal month” number

Look back at the last 3–6 months and pick the lowest month that still represents your normal life (not a disaster month).

That number becomes your baseline.

If your income is truly unpredictable, pick the lowest month you can realistically expect and build from there.

Step 2: List your essentials (and stop lying to yourself)

Essentials are:

- Housing

- Utilities

- Insurance

- Minimum debt payments

- Groceries (basic level)

- Gas/transport

Non-essentials are not “bad.” They’re just not first.

If you need a realistic mindset reset on this, this post helps a lot: the brutally honest budget that finally worked.

Step 3: Create bill guardrails (so you don’t miss stuff)

When income is uneven, bills are scarier because timing matters. A bill can hit when money is low and trigger fees.

Use a simple routine:

- Choose 1–2 bill pay days each month.

- When money comes in, pay the next must-pay bills first.

- Don’t let autopay surprise you if your balance swings.

If you’re in a “family budget survival” season, this post is also worth reading: living paycheck to paycheck with a family (what helped).

Step 4: Use a weekly plan, not a monthly fantasy

Monthly budgets are hard when income is uneven. Weekly works better because it matches reality.

Each week, you decide:

- What bills must be covered before next income hits

- Your grocery amount for the week

- Your gas/transport amount

- One “household needs” allowance

This is where people get relief. Because you’re not planning a perfect month. You’re planning a manageable week.

Step 5: Build a “low week” grocery default

This is huge.

Pick a basic grocery plan that works when money is tight, so you don’t panic-spend during low weeks.

You can use the 5 meals method from your grocery reset approach, and keep it simple. Also these two posts make a strong combo for this:

Low week success is not about creativity. It’s about having a default plan you can repeat.

Step 6: Handle “good weeks” without blowing them

This is where uneven income budgets usually die.

In a good week, you feel relief. So you spend like you’re safe. Then the next week is slow and you feel stressed again.

So here’s the rule:

On good weeks, you build stability, not lifestyle.

Do this order:

- Cover upcoming bills

- Fund groceries/gas for the week

- Pay down the most stressful balance (even a small amount)

- Put something aside as a buffer

- Then extras

If you want proof that small changes stack, this is a motivating internal read: saved $400/month with 5 simple changes.

Step 7: Protect yourself from the two biggest leaks

Uneven income budgets get wrecked by:

- Subscriptions you forgot about

- Online shopping “quick buys”

Do the subscription audit if you haven’t: I found $127/month in subscriptions I forgot.

And if Amazon is your weak spot, this is the one to use: Amazon spending out of control? how to stop.

Do this today (20 minutes)

- Pick your “worst normal month” baseline number.

- List your essentials (bills + basic life costs).

- Split your plan into Bills Bucket and Life Bucket.

- Set a weekly money check-in day (same day every week).

- Choose your “low week grocery default” (simple meals).

FAQ

What if my income is extremely unpredictable?

Then your system should be even simpler. Weekly planning, bills first, and a bigger buffer goal when you have a good week.

Should I use cash envelopes?

If you overspend easily, envelopes can help. If you’re disciplined and just need clarity, a weekly plan is enough.

How do I build a buffer if I’m barely surviving?

Start tiny. Even $10 counts. The buffer isn’t about the amount at first. It’s about building the habit of “good weeks create stability.”

Bottom line

Budgeting with uneven income is not about perfection. It’s about building a plan that survives the slower weeks and doesn’t collapse after one good week.

Two buckets, weekly planning, and leak control. That’s the system.