I used to think “no-spend weekend” people were built different.

- What a no-spend weekend is (and what it is not)

- Why families spend the most on weekends

- The rules (simple, clear, not dramatic)

- Prep on Friday (15 minutes)

- 1) Do a snack scan

- 2) Plan 5 easy meals and snacks

- 3) Pull out “free fun” options before you need them

- The weekend schedule (copy and follow)

- How to handle the hardest part: boredom spending

- Do this today (before your next weekend)

- Bottom line

Like they had magical discipline. Or a secret life where their kids never ask for snacks, nobody “needs” something from Target, and Amazon doesn’t whisper to them at 11:47pm like a villain.

Then I tried it. Not perfectly. Not Pinterest-perfect. But for one weekend, I committed to not spending money unless it was truly necessary.

And it surprised me. Not because it was easy, but because it showed me how often I spend out of habit, not need. Little things. Convenience things. “Let’s just grab…” things. And those are exactly the things that quietly drain your budget.

This is a no-spend weekend plan for families that actually works. It’s not strict in a weird way. It’s structured enough to stop impulse spending, and flexible enough to survive real life.

If you feel like your money is leaking but you can’t point to one big reason, start with this too: where does my money go? find budget leaks. No-spend weekends work best when you’re trying to plug the small leaks.

What a no-spend weekend is (and what it is not)

A no-spend weekend is not a punishment. It’s a reset.

You are not trying to prove you can suffer. You’re trying to break the loop of “bored, tired, stressed, spend.”

Here’s what it is:

- A 2-day pause on non-essential spending

- A chance to use what you already have

- A quick way to feel in control again

Here’s what it’s not:

- No groceries if you truly need basics

- No medication, gas, or real emergencies

- No “I’m failing if I spend $4” energy

The goal is to stop casual spending, not block real life.

Why families spend the most on weekends

Weekends are where budgets get wrecked because weekends are emotional.

- You’re tired from the week.

- You want a reward.

- The kids are home and hungry every 17 minutes.

- You want to get out of the house, and going out usually costs money.

Also, online shopping spikes on weekends because people finally have time to scroll. If Amazon is your weak spot (it’s a lot of us), read this before you start: Amazon spending out of control? how to stop.

The rules (simple, clear, not dramatic)

Pick your rules before the weekend starts. If you wait until Saturday afternoon, you’ll negotiate with yourself until you lose.

Rule 1: No online shopping.

No browsing “just to look.” That is how it starts.

Rule 2: No restaurants, delivery, or coffee runs.

You can still have fun. You just bring the fun home.

Rule 3: Gas only if necessary.

Don’t drive around bored. Bored driving leads to spending.

Rule 4: One planned exception (optional).

If you know you’ll lose your mind without one tiny treat, plan it. Put a cap on it. Then stop. For example: “We can spend $10 on a movie rental” or “$8 for a treat.” Planned is controlled. Random is chaos.

If you struggle with all-or-nothing thinking, this post helps ground it: no-buy month saved $340 without feeling deprived.

Prep on Friday (15 minutes)

This is the part that makes it actually work.

1) Do a snack scan

Weekend spending often starts with “we have nothing to eat.” So check what you already have: popcorn, pasta, rice, eggs, frozen nuggets, tortillas, peanut butter, whatever your basics are.

If you truly need groceries, buy only essentials and only what’s needed for the weekend. Keep it tight. No wandering.

2) Plan 5 easy meals and snacks

Not gourmet. Just simple.

- Breakfast: eggs, oatmeal, pancakes, cereal

- Lunch: sandwiches, leftovers, quesadillas

- Dinner 1: pasta night

- Dinner 2: breakfast for dinner or taco night

- Snacks: popcorn, fruit, yogurt, peanut butter toast

If grocery spending is a bigger problem for you, this post pairs perfectly with no-spend weekends: meal plan on a budget when groceries are expensive.

3) Pull out “free fun” options before you need them

If the kids see a plan, they stop asking for “can we go somewhere.” Not always, but it helps.

Pick 6 activities from this list and write them down:

- Family movie night (at home)

- Board game tournament

- Living room “campout”

- DIY pizza night (use what you have)

- Dance party for 20 minutes (yes, even if you’re tired)

- Free park day

- Neighborhood walk scavenger hunt

- Library trip (free)

- Kitchen “bake something” challenge

- Declutter one drawer as a family race

The weekend schedule (copy and follow)

You don’t have to follow this perfectly. The point is to remove decision fatigue.

Saturday morning

- Breakfast at home

- 10-minute house reset (everyone does one small thing)

- Free activity: park, walk, library, or backyard

If your home tends to feel chaotic and that chaos triggers spending (“we need bins, we need stuff”), this post can help shift that mindset: organize your home on a budget without expensive bins.

Saturday afternoon

- Lunch at home

- “Use what we have” snack tray

- 1 hour of free entertainment: games, puzzles, crafts, sports outside

Saturday evening

- Dinner at home

- Family movie night or game night

- Optional planned treat (if you chose one)

Sunday morning

- Simple breakfast

- Free activity: library, park, visit family, nature walk

- Meal prep one thing that makes Monday easier

Sunday afternoon

- Leftovers lunch

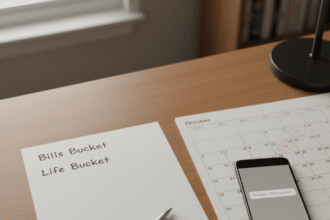

- Pick one “money win” task: subscription audit, bills list, pantry scan

If you haven’t done a subscription audit yet, that’s the highest impact weekend money task. This is the post that usually shocks people: I found $127/month in subscriptions I forgot I had.

How to handle the hardest part: boredom spending

Boredom spending is real. You think you’re bored, but you’re actually restless. Your brain wants stimulation.

So replace the “scroll and buy” habit with a short stimulation habit:

- 20-minute walk

- 10-minute kitchen reset

- music + clean one small area

- text a friend

- do a quick “cart cleanup” without checkout

If Amazon is where boredom spending hits hardest, your best next step is this system: stop the Amazon spending spiral (saved $200/month).

Do this today (before your next weekend)

- Pick your weekend rules.

- Plan simple meals and snacks.

- Write down 6 free activities.

- Choose 1 money task for Sunday.

Bottom line

No-spend weekends work because they interrupt the spending loop. They give your budget a breather and remind you that you can have a good weekend without buying your way through it.

And if nothing else, it gives you one small win. When money feels stressful, small wins matter more than people admit.