The idea of a “3‑month emergency fund” honestly used to make me mad. I’d hear advice like “just save 3–6 months of expenses” and think, “Cool, with what money exactly?”

We were living that paycheck to paycheck with a family life. By the time bills and groceries were paid, there wasn’t much left. An emergency fund felt like a rich‑people project.

But I got tired of the constant tight‑rope walk. One surprise bill could spin everything. So I decided to treat building a 3‑month cushion like a long, slow mission instead of a quick challenge. No magic, just tiny moves that added up.

Here’s exactly how it happened.

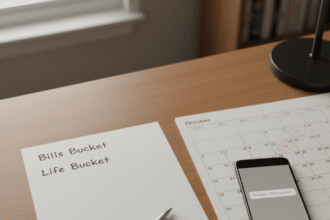

Step 1: Figure out what “3 months” actually meant for us

The phrase “3 months of expenses” sounds huge, but seeing a real number helped. I took:

Rent

Average utilities

Groceries

Gas

Minimum debt payments

Non‑negotiable bills (insurance, phones, etc.)

I ignored extras for now. This wasn’t “dream life” money. It was “keep the lights on and food in the house” money.

That total for one month became my baseline. Multiply by three and suddenly the big scary emergency fund had an actual number. Still intimidating, but at least it was concrete.

This part felt very similar to the honesty in your brutally honest budget that finally worked after I failed 12 times. No pretending, just math.

Step 2: Plug the immediate leaks

Saving on top of a leaky budget is brutal. So before trying to pile money into savings, I hunted leaks with your where does my money go mindset.

I did:

A quick subscription audit

A small energy bill reset

A reality check on our grocery habits using the grocery spend reset

Together with changes from saved $400 month 5 simple changes, we freed up about $150–$200 most months. Not glamorous. But that became the “emergency fund seed money.”

Step 3: Start laughably small (on purpose)

At first, I didn’t try to save hundreds. I picked a tiny number I knew I wouldn’t talk myself out of: $10 a week.

It sounded pointless. But it did two things:

Built the habit of movable money (“some of this needs to go aside”)

Made the savings account feel less empty and scary

Once I was used to that, I nudged it to $20, then $40 on good weeks. When extra came in, like a mini windfall or side income, I’d send a chunk straight into savings before my brain could get ideas.

The rules felt a lot like your no‑buy month saved $340 without feeling deprived: simple, flexible, and not all‑or‑nothing.

Step 4: Give the emergency fund a separate “home”

I knew myself. If the savings sat in the same bank app as my spending account, I’d “accidentally” use it.

So I:

Opened a separate high‑yield savings at a different bank

Nicknamed it “oh no money”

Made it slightly inconvenient to transfer out (not instant, but not impossible)

Some people use literal cash in an envelope or a small safe. If that feels safer for you, go for it. The key is treating it differently from “fun money” or “extra checking balance.”

Step 5: Use mini challenges instead of trying to be perfect

Here’s where I leaned on your style of little resets:

A no spend weekend plan for families once a month, then sending the saved fun money to the emergency fund

A no‑buy month once or twice a year, with a specific savings goal

A few “Amazon resets” using stop the Amazon spending spiral and the 48 hour cart rule

Those little bursts did more than strict monthly rules ever did for me. And each time, I moved the extra directly over before we forgot it existed.

Step 6: Balance saving with debt payoff

I know some people say, “Don’t save until all your debt is gone.” Others say, “Save first, worry about debt later.” I ended up somewhere in the middle, kind of like your debt snowball starter guide.

We:

Kept minimum payments on everything

Built a tiny starter emergency fund first (about $500)

Then split extra money: a chunk to debt, a chunk to the bigger emergency goal

The small starter cushion stopped every flat tire or surprise bill from going straight on a card. That alone slowed the debt spiral down.

Step 7: Adjust for uneven income months

We don’t have perfectly predictable income every month, and I know a lot of families don’t. So we used a lighter version of your budget with uneven income simple system.

On higher‑income months:

Cover essentials

Send extra to emergency savings and sometimes debt

On lower‑income months:

Cover essentials

Pause extra savings if needed

Only use emergency fund for actual emergencies, not “we want takeout”

That flexibility kept us from giving up the first time a rough month hit.

How long it actually took

It did not happen in 30 days. It took us a little over two years to get to a full 3‑month cushion. Not linear, not perfect. Some months we saved $20. Some months a car repair knocked us back and we had to refill.

But we got there.

And once that fund existed, everything felt different. An unexpected bill was still annoying, but it wasn’t terrifying. We could breathe.

FAQs

How much should I save before I start tackling debt more aggressively?

A lot of people like having at least $500–$1,000 as a starter cushion before focusing harder on debt. It’s enough to handle minor emergencies without derailing everything. After that, you can split extra between debt and growing the emergency fund.

What counts as an “emergency” for this fund?

Things like job loss, medical bills, car breakdowns, essential home repairs, or travel for family emergencies. Not sales, birthdays, or “I’m tired and want takeout.” You can still have fun money, but try to keep this fund for genuine “we’d be in trouble without this” moments.

How do I save when I’m already living paycheck to paycheck?

Start tiny. Think $5–$10 a week. Use tools like where does my money go, saved $400 month 5 simple changes, and subscription audit to free up small amounts. Then automate moving that money into a separate account so you’re not constantly deciding.

Should I keep my emergency fund in cash or the bank?

For most people, a separate savings account is best. It’s safe, easy to access in a real emergency, and slightly annoying to touch for non‑emergencies. If cash feels safer for you, consider keeping a small chunk at home in a safe for immediate needs and the rest in the bank.

What if an emergency drains my fund and I have to start over?

That’s actually the fund doing its job. You’re allowed to feel frustrated, but try to see it as “this prevented debt or disaster,” not “I failed.” Rebuild using the same steps, maybe starting with a smaller goal like one month of expenses before stretching to three.

Can I work on an emergency fund and a big goal (like a move) at the same time?

Yes, but give the emergency fund first priority until you have at least a small cushion. After that, you can split extra between the emergency fund and your goal. Just make sure you’re not using “future goals” as a reason to leave yourself totally unprotected right now.

What if my number feels impossibly big?

Break it down. If your three‑month goal is $6,000, that’s $500 a month for a year, or about $115 a week for a year if you want it sooner. Maybe you can’t hit that yet. But could you start with $20 a week while you work through living paycheck to paycheck with a family and saved $400 month? You don’t have to do it fast. You just have to start.